India is the second largest manufacturer of textile and apparel in the world. Indian textile and apparel market is estimated at US$ 122 Bn., 70% of which is domestic consumption while exports constitute the rest 30%. The sector in India has been growing in double digits for the last many years despite global uncertainties and demand slowdown.

As a sector specialist consultant, Wazir Advisors has been an active participant in the evolution of sector as an advisor, a thought leader and an implementation partner. Looking at the macro economic factors and emerging trends, we believe that the real growth phase of industry is about to start. Our bullish thoughts are rooted in few fundamental reasons which are somewhat unique to India. In the following narrative, we explain why India is poised to be the powerhouse for textile and apparel manufacturing, exports and consumption in near future.

Indian has a large raw material base covering all types of natural and synthetic fibres which has helped it to achieve a global stature. It is the largest cotton producer in the world with a share of approx. 27% of the global cotton production. India is also the second largest producer of polyester globally with 8% global share. Viscose is another key textile fibre for which India is 3rd largest producer in the world.

Table 1: Fiber Production in India and India’s Global Standing

| Fiber type | 2016-17 Production (Mn. kg.) | Global rank | |

| Natural Fibers | |||

|---|---|---|---|

| Cotton | 5,865 | Largest producer | |

| Jute | 1,884 | Largest producer | |

| Wool | 46 | 10th largest producer | |

| Synthetics | |||

| Polyester Filament Fiber | 1,060 | 2nd largest producer | |

| Polyester Staple Fiber | 899 | 2nd largest producer | |

| Acrylic Staple Fiber | 96 | 4th largest producer | |

| Polypropylene Filament Yarn | 11 | ||

| Artificial | |||

| Viscose Staple Fiber | 365 | 3rd largest producer | |

| Viscose Filament Yarn | 46 | ||

Source: Office of Textile Commissioner, Government of India

Many other Asian and African countries like Bangladesh, Vietnam, Myanmar, Ethiopia, Kenya, Cambodia and Sri Lanka lack such a diversity. Their value chain remains dependent on imports from other countries which has its fair share of business risks. India, however, stands self-reliant in fulfilling its raw material requirements for textile and apparel manufacturing.

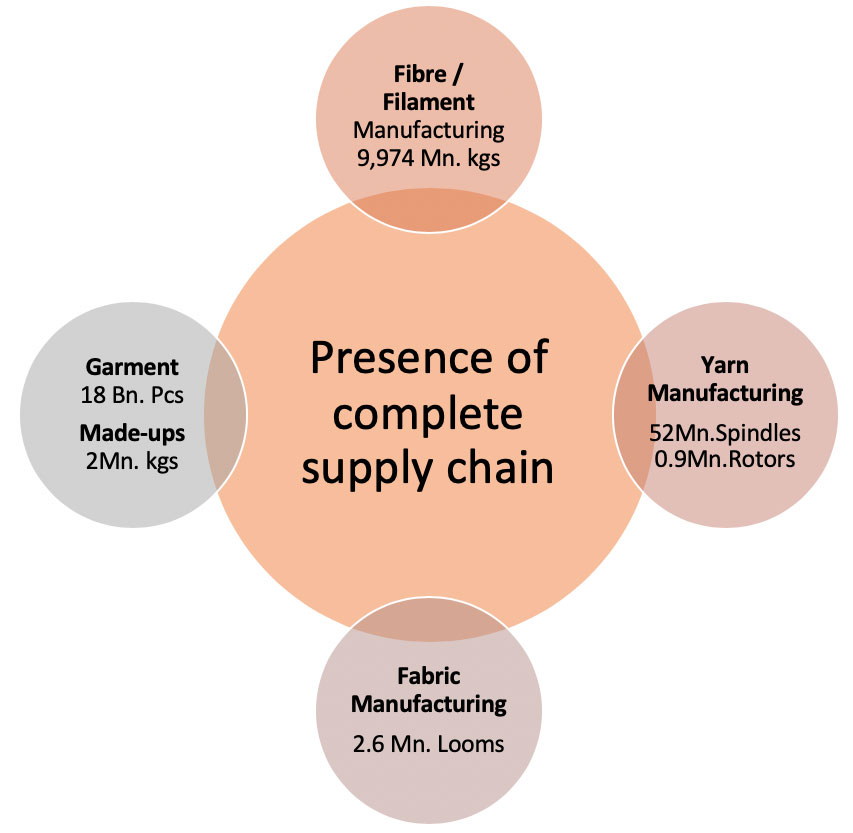

India is one of the few textile manufacturing countries in the world where all levels of textile value chain i.e. from fibre/ filament to garment/made-ups manufacturing are present.

Figure: Indian textile manufacturing value chain

In contrast, countries like Bangladesh, Vietnam, Sri Lanka, Myanmar, Ethiopia and Cambodia have fragmented value chains; mostly focused on end-product and dependency on the other countries for fabric and yarn.

India is not a low-cost manufacturing destination, but remains competitive due to a number of factors. The wage cost in India is higher than Bangladesh but lower than that in China and Vietnam. In terms of power cost, India is comparable to low cost destinations like Bangladesh, Vietnam, Myanmar, Kenya etc. but higher than that in China. The lending rates in India are on higher side as compared to China and Vietnam but with special Government support available for the sector, the effective cost of capital becomes comparable.

Figure: Factor Cost Comparison of India with Competing Countries

| Cost element | Unit | China | India | B’desh | Vietnam | Cambodia | Ethiopia | Kenya |

|---|---|---|---|---|---|---|---|---|

| Labour cost * | US$/ Month | 550-600 | 160-180 | 100-110 | 170-190 | 180-190 | 60-80 | 170-190 |

| Power cost | US$/kwh | 0.15-0.16 | 0.10-0.12 | 0.09-0.12 | 0.08-0.10 | 0.20-0.25 | 0.03-0.04 | 0.09-0.20*** |

| Lending rate | % | 5-6% | 11-12% | 12-14% | 6-7% | 14-16% | 6.5-7.5% | 16-18% |

| Water cost** | US Cents /m3 | 55-60 | 16-20 | 20-22 | 50-80 | 70-90 | 70-90 | 150-180 |

Source: Wazir analysis

* cost for semi-skilled labour; includes all benefits

**Water cost is based on the average tariff of the water supply companies of specific countries

***9 cents for EPZ units

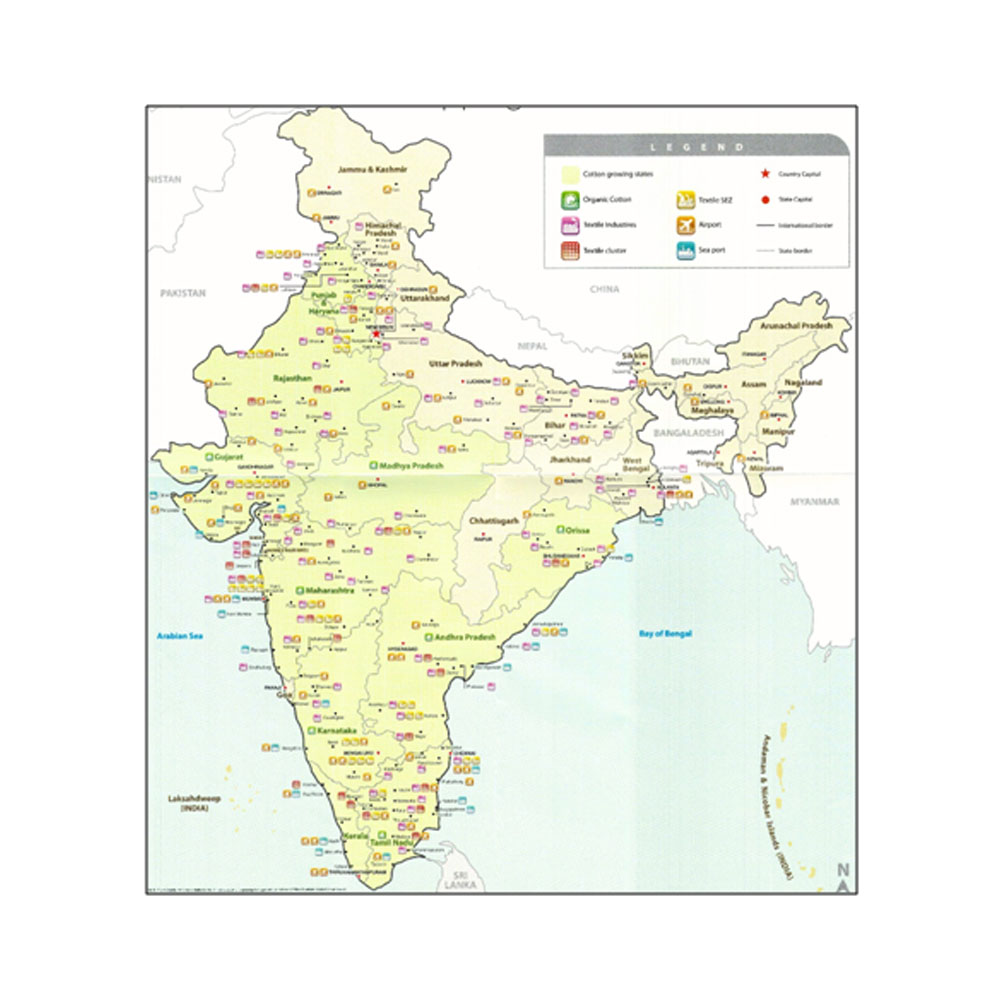

India has a long tradition of textile and apparel manufacturing with infrastructure spread across the country in various clusters. Few important industry clusters are depicted below:

Figure: India’s Textile & Apparel Clusters

In addition to the traditional, natural manufacturing clusters, new virtual clusters are being developed with support from Indian central and state governments in form of textile and apparel parks. Till date, central government has sponsored 66 such parks across states which are at various stages of implementation.

Special Economic Zones (SEZ) is another form of support that aids the textile and apparel exporters to be globally competitive. Indian central and state governments also support in the establishment of Centres of Excellence (CoEs), R&D facilities, etc. which are key infrastructure tools for the growth of textile industry.

India has the largest youth population in the world with 65% of its population below 35 years of age. The demographic dividend will allow India to successfully lead as a manufacturer of labour intensive products such as textile and apparel in foreseeable future. With increasing emphasis on quality, demand of skilled labour will rise in the coming time. Realizing this, the Government of India has implemented several initiatives to develop pool of skilled manpower in India.

English, being second language after mother tongue, is understood and used commonly as a medium of spoken and written communication. This is another key advantage for global companies to set up their operations in India, whether sourcing or manufacturing.

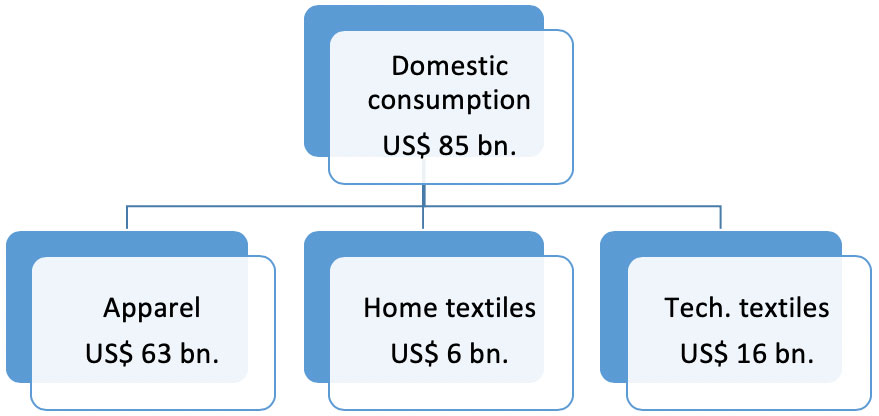

The Indian domestic consumption of textile and apparel is valued at US$ 85 bn. in 2016. Within this, apparel retail contributes US$ 63 bn., technical textiles contribute US$ 16 bn. and home textiles contribute US$ 6 bn.

Figure: Indian Domestic Textile and Apparel Consumption (2016)

Source: Wazir Analysis

In last decade, Indian domestic market has performed better than the largest consumption regions like US, EU and Japan, where depressed economic conditions led to lower demand growth. The domestic apparel consumption of India has grown at a robust CAGR of 11% since 2005. Due to presence of strong fundamentals, the domestic apparel market size of India is expected to reach a level US$ 220 bn. by 2025.

Studies show that countries after achieving a per capita GDP of more than US$ 2,500 experience a spur of economic growth led by consumer spending. The Indian economy is expected to reach this target by 2020. This will help in exponential growth of textile and apparel consumption with the country. Beyond the increasing income of Indian consumers that is making them buy more, and better; the market growth will be led by following important drivers:

Government of India has launched various support schemes for textile and apparel manufacturers to make them globally competitive. The Schemes target technology upgradation, infrastructure development, export promotion etc. Last year, Government of India had announced a US$ 1 bn. per annum special package for next 3 years for garment and made-ups manufacturers. Various State Governments have also announced their Textile Policies aimed at attracting investments in their states.

A summary of the major Central Government schemes currently being implemented by Ministry of Textiles is given ahead:

Table 1: Central Government Schemes for Textile Sector

| Scheme / Policy | Key Features |

| Modernization Schemes | |

|---|---|

| Amended Technology Upgradation Fund Scheme (ATUFS) | Support for installing modern, high technology machinery |

| Infrastructure Development Schemes | |

| Scheme for Integrated Textile Parks (SITP) | Support for setting up of textile parks |

| Integrated Processing Development Scheme (IPDS) | Support for setting up processing parks |

| Skill Development Schemes | |

| Integrated Skill Development Scheme (ISDS) | Support for training workforce in textile and apparel industry |

| Export Promotion Schemes | |

| Duty Drawback and Merchandize Exports from India Scheme (MEIS) | Duty neutralization schemes |

| Market Development Assistance (MDA) and Market Access Initiative (MAI) | Support for conducting overseas marketing |

India currently enjoys preferential market access to 43 countries under 15 trade agreements. Some of the key agreements are as follows-

South Asia Free Trade Area (SAFTA): India, Pakistan, Nepal, Sri Lanka, Bangladesh, Bhutan, Afghanistan and the Maldives.

Asia-Pacific Trade Agreement (APTA): Bangladesh, China, India, Republic of Korea, Lao People’s Democratic Republic, Sri Lanka and Mongolia.

Comprehensive Economic Partnership Agreement (CEPA) with Japan and South Korea

Comprehensive Economic Cooperation Agreement (CECA) with ASEAN Countries (Singapore, Vietnam, Malaysia, Thailand, etc.)

EU has granted India with GSP status for garments under which Indian garment exports to EU attract 20% less duty than the MFN rate.

India is currently negotiating FTA with EU, Australia and Canada; and RCEP is also under discussion with 16 Asia-Pacific countries including China.

Indian textile industry is marked by presence of large scale manufacturers across the value chain i.e. from yarn to finished goods. These diversified textile conglomerates have huge manufacturing capacities, compliant set-ups for high quality goods manufacturing and are well-recognized by world-wide buyers. Some of the largest textile and apparel companies in India are as ahead:

Table 2: Leading Textile Companies in India & their Turnover

| S. No. | Company Name | Products | Headquarters | Turnover 2016-17 (US$ Mn.) |

|---|---|---|---|---|

| 1 | Reliance Industries* | Fiber, filament, fabrics | Mumbai, Maharashtra | 2,300 |

| 2 | Birla Cellulose | Fiber | Mumbai, Maharashtra | 1,187 |

| 3 | Arvind | Fabrics, apparel | Ahmedabad, Gujarat | 916 |

| 4 | Vardhman Textiles | Fiber, yarn, fabrics, apparel | Ludhiana, Punjab | 881 |

| 5 | Welspun India | Home textiles | Mumbai, Maharashtra | 868 |

| 6 | Aditya Birla Nuvo | Yarn, fabrics, apparel | Mumbai, Maharashtra | 776 |

| 7 | Trident Group | Yarn, home textiles | Ludhiana, Punjab | 721 |

| 8 | JBF Industries Ltd. | Polyester chips, yarn | Mumbai, Maharashtra | 602 |

| 9 | SRF Ltd. | Technical textiles | Gurgaon, Haryana | 597 |

| 10 | Bombay Rayon Fashions Ltd. | Yarn, fabrics, apparel | Mumbai, Maharashtra | 596 |

Source: Moneycontrol

*Estimated

Many of these are already in partnerships or JVs with global companies and many more opportunities can be explored further in different form of partnerships.

India is a land of cultural diversity with amalgamation of many cultures and religions. There are around 22 official languages spoken in the country. It is the biggest democracy in the world with a large and growing middle class. India also has the largest Gen Y population in the world with a median age of 27 years. Almost half of the Indian population is under 25 years which will soon join the workforce and add to increasing purchasing power. There has been considerable progress and improvement in terms of education and expansion of literacy India that has become one of the major contributors to its economic development.

India has a stable and a supportive government which has been instrumental in developing business friendly policies. The steady government facilitates secured environment for the global companies to establish their base in India that is in contrast to other emerging textile bases like Bangladesh, Pakistan, and Ethiopia etc. which are marred by political and social instability. Indian government has made focused efforts in improving economic systems to attract foreign investors, enhance international trade, and increase transparence. As a result, foreign direct investment (FDI) inflows into India in 2017 calendar year were recorded to be US $43 Bn, according to Department of Industrial Policy & Promotion, Government of India. There has been a cumulative infusion of US$ 484 Bn. in India from last 16 years and India has emerged as one of the most attractive destinations for investment and business in recent years.

With the increasing support from Indian government and focused efforts by large integrated and private players, the country is expected to lure significant global businesses to India. It is envisaged that Indian market will continue its upward trajectory in years to come leveraging its inherent strengths and macro-economic drivers.

The article has been authored by Ayushi Puri, Consultant and Disha Acharya, Consultant.

It was published in April 2018 in the Images Yearbook.