Figure 1: Maslow’s Hierarchy of Textiles and Apparel for an Average Consumer

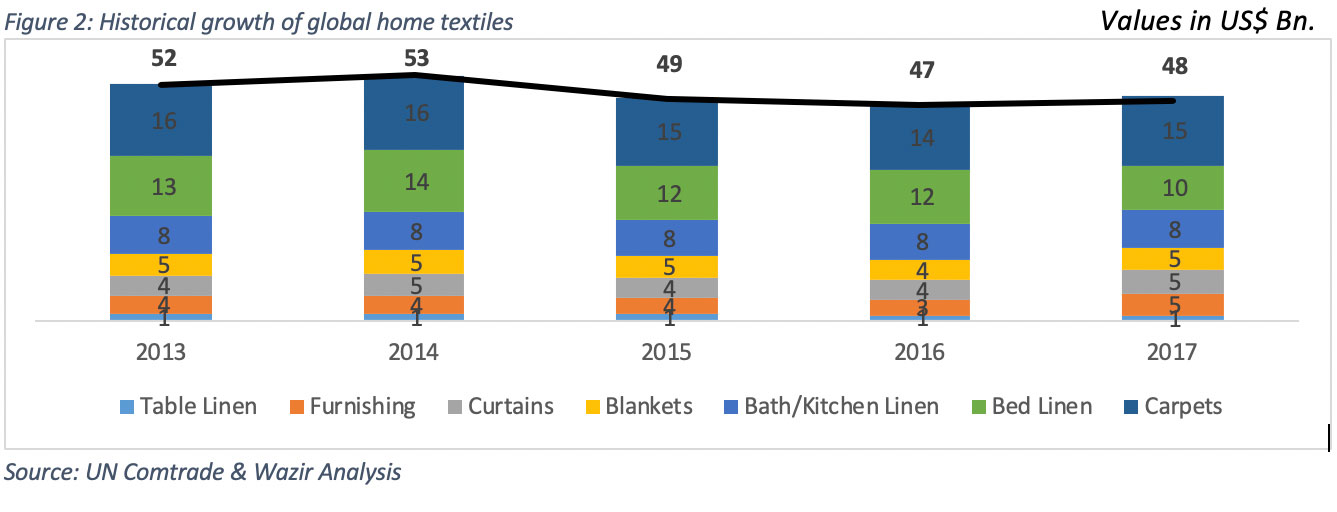

Figure 1: Maslow’s Hierarchy of Textiles and Apparel for an Average Consumer The year 2017 saw a global trade worth US$ 777 Billion of Textile and Apparel commodities, which is a direct growth of 5% year-on-year from the previous years’ US$ 743 Billion. The overall growth was reflected in the Home textiles segment as well, increasing the trade from US$ 47 Billion in 2016 to US$ 48 Billion in the current year. On a broader perspective, Home textiles accounts for 6% of the total T&A trade.

The growth in Trade of Home textiles this year as compared to last year could be credited to the growth in the Carpets, Blankets, Curtains and the Furnishing segments. However, the Bed linen segment saw a sudden drop in the trade and for the first time in last 6 years fell below US$11 Billion.

Table 1: Top Ten Traded Home Textiles Commodities

| S.No. | HS Code | Description | Value | % Share |

| 1 | 630260 | Cotton terry towels | 6,697 | 14% |

| 2 | 630140 | Blankets & travelling rugs, of synthetic fibres | 3,696 | 8% |

| 3 | 630392 | Curtains of synthetic fibres | 3,526 | 7% |

| 4 | 630231 | Cotton bed linen | 3,470 | 7% |

| 5 | 570330 | MMF based Carpets & other textile floor coverings | 3,082 | 6% |

| 6 | 570320 | Nylon and Polyamides based Carpets | 2,899 | 6% |

| 7 | 570242 | MMF Carpets & textile floor coverings | 2,584 | 5% |

| 8 | 630221 | Printed Cotton Bed linen | 1,803 | 4% |

| 9 | 630232 | MMF based Bed linen | 1,795 | 4% |

| 10 | 570500 | Other Carpets & other textile floor coverings | 1,596 | 3% |

| 11 | – | Others | 17,283 | 36% |

| total | – | Others | 48,436 | 100% |

Source: UN Comtrade & Wazir Analysis

The Top ten traded commodities accounted for almost 64% of the total Home textiles global trade. Cotton terry towels were single largest commodity with a massive market share of 14%. Moreover, out of the top 10 commodities, 4 commodities belong to the Carpets segment.

Home textiles market demand has varied over the last few years. However, the major markets have remained more or less the same. An analysis of the top 10 importers creates a clear picture of the geographical demand of home textiles.

The Major markets of EU and USA have shown a rather positive trend of growth since 2013. However, the overall trade of Home textiles has come down from US$ 53 Billion in 2013 to US$ 48 Billion in 2017. The global trade saw a slowdown in the years following 2013, however the trade has picked up its pace again in the last couple of years.

Russia has witnessed a steep fall in home textiles imports at a CAGR of negative 23% since 2013. The biggest gainer in last few years has been Kazakhstan, growing at a CAGR of 7% in last 4 years.

Table 2: Top Ten Market of Home Textiles in 2017

| Country | US$ Mn. | CAGR (’13-’17) | Share |

| EU-28 | EU-28 | 0% | 36% |

| USA | 11,780 | 2% | 24% |

| Japan | 2,320 | -7% | 5% |

| Canada | 1,623 | -2% | 3% |

| Australia | 1,144 | -3%s | 2% |

| UAE | 850 | -7% | 2% |

| Saudi Arabia | 788 | -5% | 2% |

| Russia | 716 | 7% | 1,795 |

| Kazakhstan | 605 | 7% | 7% |

| Switzerland | 544 | -2% | 1% |

| R.O.W | 9,910 | Others | 21% |

| Total | 48,436 |

Source: UN Comtrade & Wazir Analysis

Although the imports from major markets except USA and EU have shown a downwards trend, the exports from Asia have stayed afloat. Analysis of major exporters shows that China, similar to all other textile segments has started to focus more on fulfilling the domestic demand and is vacating a share of market in doing so. On the other hand, India, Turkey and Pakistan have consolidate their position behind China and have sustained their exports irrespective of a dip in the overall trade. European countries like Belgium, Germany, Netherlands and Portugal also have a significant share in the Global trade of home textiles and have grown at a pace faster than Asian countries.

Table 3: Top Ten Exporters of Home Textiles in 2017

| Country | US$ Mn. | CAGR (‘13-‘17) | Share |

| China | 18,798 | -2% | 39% |

| India | 5,209 | 0% | 11% |

| Turkey | 3,681 | -1% | 8% |

| Pakistan | 3,401 | 8% | 7% |

| Belgium | 2,204 | 5% | 5% |

| Germany | 1,675 | 2% | 3% |

| Netherlands | 1,633 | 1% | 3% |

| USA | 1,421 | 5% | 3% |

| Portugal | 734 | -6% | 2% |

| R.O.W | 9,910 | Others | 21% |

| Total | 48,436 | -2% |

Source: UN Comtrade & Wazir Analysis

Table 4: Regional Analysis of Exports of Home Textile in 2017

| Region | Exports US$ Mn. | Share | Change in % share since 2013 |

| Asia | 29,407 | 61% | -1.7% |

| EU-28 | 11,518 | 24% | 1.9% |

| Other Europe | 4,083 | 8% | 0.2% |

| North America | 1,651. | 3% | 0.0% |

| Latin America and the Caribbean | 901 | 2% | -0.1% |

| Africa | 718 | 1% | -0.3% |

| Oceania | 159 | 0% | 0.0% |

Source: UN Comtrade & Wazir Analysis

A regional analysis of exports shows that the Asia holds 61% share in the global home textiles share. China is the most dominant among Asia with a 64% share in the continent. Over the last 4 years, Asia has lost only 1.7% of its share in global trade, while EU-28 countries have gained 1.9%. This reflects the resurgence of European weaving industry and the European countries realizing the importance of innovation and filling the space vacated by China with their quality product.

The Asian Manufacturers are facing some challenge from European countries, but it is not critical at the moment and should reduce as India, Pakistan and Turkey, develop capacities and invest extensively in research and development.

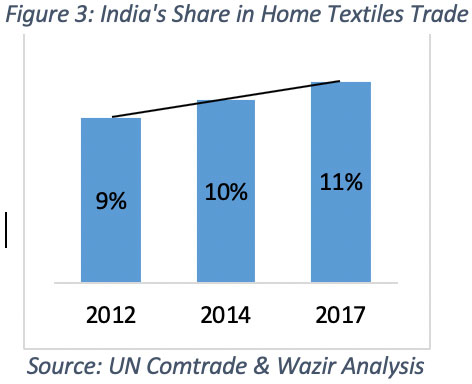

India over the last few years has consolidated its position as the second largest exporter of Home textiles in the World, only behind China. India has withstood the fluctuations in the Global trade and has had a steady growth in share in the overall trade which accounts for 11% currently. India is not only one of the biggest supplier but also one of the largest consumer of home textiles. Major home textiles players such as Welspun India, Trident and Dicitex are already based in India.

Indian companies since the onset of this decade have been investing intensively in capacity building and have managed their capacities efficiently to cater both, domestic as well as export demands. Various companies have come up with greenfield and brownfield investments in the sheeting industry, which has strengthened India’s world presence in sheeting.

India has traditionally exported home textiles primarily to EU and USA, which constitute around 81% of India’s home textiles exports among them. India has a dominating presence in USA, with a market share of close to 25%. India also has a significant share in home textile imports of Australia and UAE, amounting to 14% and 16% respectively. A minor increase in trade to USA as well as a stable flow of trade into EU has helped India in stabilizing the exports in comparison to the global decrease of around 8%. Over the last few years, UAE has emerged as one of the largest importers of home textiles in India. 51% of UAE’s imports from India are home linen, while Carpets account for 43% of the imports.

Table 5: India’s Exports of Home Textile to major markets in 2017

| Categories | Exports in US$ Mn. | Share |

| Home Linen | 2,351 | 45% |

| Carpets | 1,752 | 34%</td |

| Furnishing | 925 | 18% |

| Blankets | 180 | 3% |

Source: UN Comtrade & Wazir Analysis

Table 6: Category-wise Analysis of Exports in 2017

| Country | US$ Mn. | CAGR (‘12-16) | Share |

| USA | 2,853 | 1% | 55% |

| EU-28 | 1,347 | 0% | 26% |

| Australia | 156 | -2% | 5% |

| UAE | 132 | -6% | 3% |

| Canada | 1,144 | -3%s | 2% |

| Japan | 850 | -7% | 2% |

| Saudi Arabia | 788 | -5% | 2% |

| China | 716 | 7% | 1,795 |

| South Africa | 605 | 7% | 7% |

| Chile | 544 | -2% | 1% |

| R.O.W | 9,910 | Others | 21% |

| Total | 48,436 |

Source: UN Comtrade & Wazir Analysis

The stability of Indian exports could be attributed to the support provided by the Government towards home textiles. Also, central government schemes like TUFS and various state government schemes have created a favorable ecosystem for the home textile manufacturers in India.

Figure 4: Commodity wise opportunities for Indian companies

Indian Top Traded Commodities

New Product Categories

Source: UN Comtrade & Wazir Analysis

The growth in the exports of blankets and carpets can be attributed to the government’s efforts to market and popularize the traditional Indian blanket and carpet weaving industry. Indian traditional products have a niche for the across the western countries, while countries like China and UAE are attracted to India for Curtains and Home linen respectively.

In the coming times, Indian manufacturers of Home Textiles need to focus extensively on increase capacities, technology upgradation and invest towards Research & Development. The modern technologies and higher production capacities along with the capability of producing various type of products will enable India to more effectively take advantage of China’s domestic drive and take up the share given away by it. The State and Central government policies put manufacturers in a sweet spot where they’re supported to enhance their competitiveness.

With Pakistan losing out to competition in the recent years due to unrest as well as unfavorable policies and outdating technologies, creates a golden opportunity for the Indian manufacturers to optimize their capacities and aim for a higher capacity utilization.

Also the recent presence and growth of stores like Fab India, Home Stop, Home Centre, etc has given a better platform to the domestic manufacturers to reach a larger audience through a well-sorted supply chain with minimal risks as compared to exporting. Domestic E-commerce retailers like Amazon, Flipkart, Snapdeal, etc have boomed massively in the last 5 years and are growing at 19% yearly. These e-commerce platforms not only provide a common and easily accessible market place, but also have launched their private labels for home textiles. These private labels offer economical bed linen, curtains and blankets which has helped in increasing the domestic market. The growth in both the exports and the domestic demand, manufacturers have an opportunity to balance these both and maximize their profit margins.

Rising population and improving standards of living result in an increasing number of people residing in their separate homes and has in recent times propelled the home textiles market. The high demand and growing consumer awareness makes home textiles a lucrative business.

One of the major factors driving growth is flourishing home textiles market in the Asian economies such as China, India, Thailand, etc. Though the major consumer base still exists in USA and European markets but an increasing trend of household purchases is also visible in these Asian economies due to a flourishing housing market and rapidly growing middle class.

Moreover, financial stability in the last decade has led to an increased awareness among the customers and has also lead to fast fashion not being limited only to clothing, but has also made its way into home textiles. Consumers are focusing on home fashion more than ever and a stylish home has become a fashion quotient.

Various brands have recognized the potential of home textiles and are investing extensively in promoting and expanding their reaches to an increasing number of audience. Retailers like, IKEA, H&M Home, Home Depot are pioneers of this field and are known for their huge stores with customer centric products. These retailers have their sourcing and design offices in Asian countries for a faster development of products. Such innovative approaches and investments are testimonials to the growth that the industry is expecting from the segment.

Figure 5: Home Textile Growth (2005-2025)

Asian countries have developed several special finishes such as anti-microbial, anti-mist, herbal, etc.as well as various weaving techniques which have also been the reason for the dominance of Asia in world trade. With inclusion of more technologies and techniques, the productivity as well as the quality of the products are expected to increase. It can be readily said that going forward, the home textiles trade will grow at a rate of 6%. Further, the home textiles segment has become increasingly competitive and only cost driven organizations delivering product quality and customer satisfaction can survive in this cost-driven market scenario.

Given the traditional dominance, increasing demand and frequent innovations in the segment, we can say that the Global Home Textiles industry is expected to grow steadily to grow to US$ 80 Billion at a CAGR of 6% till 2025.

The article has been authored by Sanjay Arora, Business Director and Priyam Pandit, Research Analyst.

It was published in January 2019 in the Heimtextil 2019 edition of the Textile Magazine.