Intimate wear has come a long way from being only a functional basic necessity to becoming the next big style statement. Intimate wear is one of those unique products that fall in the category of both a necessity and a luxury. From traditional market with poor production and marketing infrastructure today a lot of experimentation is happening in terms of product design, style, colors & fabrics. Many domestic and international brands have forayed into the segment seeing its huge potential. This article discusses about the current scenario intimate wear scenario in India and abroad and way ahead for India to emerge as a strong player in intimate wear manufacturing.

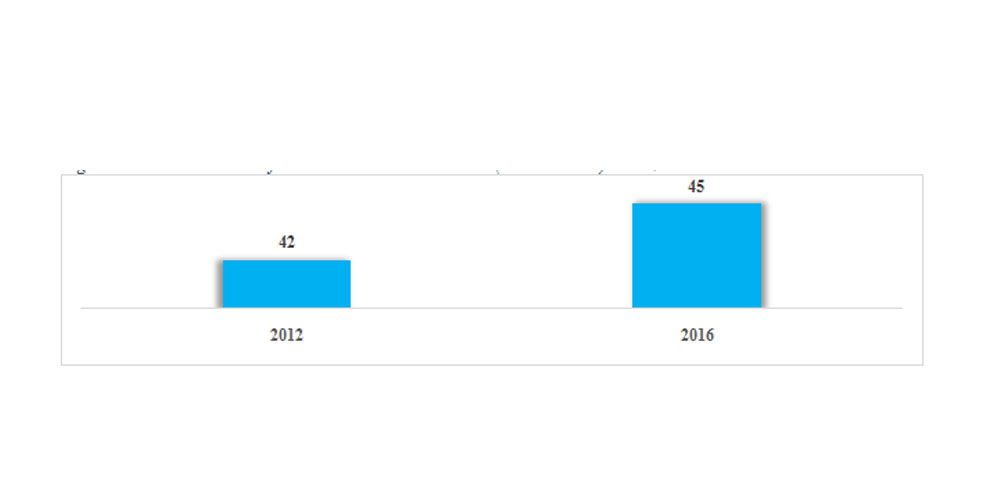

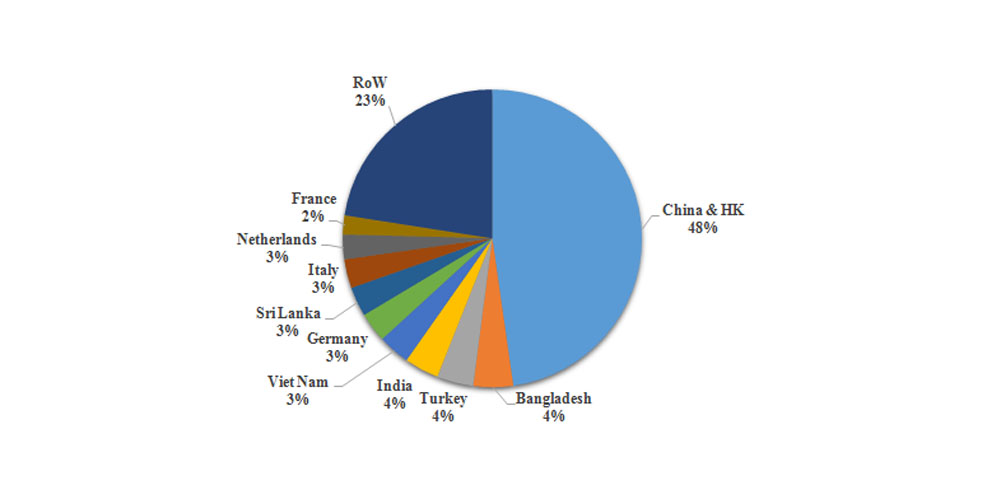

The global market for intimate wear is ever-expanding fuelled by growing global demand, changing dynamics of the end consumer and innovative new technologies. A range of attractive and practically useful innerwear have flooded the markets from many global brands vying for the top spots especially in womens’ intimate wear category. Globally innerwear exports amounted to approximately US$ 45 Bn. in 2016. It is expected to reach US $ 80 bn by 2025. China & Hongkong are the major exporting nation of innerwear for men and women with a value of US$ 21.3 Bn. which is a 47% share in global exports. Following closely behind are Bangladesh, Turkey, India and Vietnam, with 4.3%, 4%, 3.7% and 3.4% share respectively. India holds the fourth position globally with around 4% share of global exports and approximately US$ 1.7 Bn. exports value in 2016. Countries such as Bangladesh, Sri Lanka and Vietnam have marched ahead in innerwear trade mainly due to large manufacturing set-ups, economies of scale, huge investments, market access arrangements and strong focus on design and R&D which are some areas in which India is still lacking in. For example, Sri Lankan brand Amanté is widely selling in India for over a decade through multi-brand retailers and e-commerce platforms. Witnessing their huge success, the company MAS Holdings has already sanctioned over 100 exclusive stores for their lingerie brand (Amanté) all over India. The strategy being employed here is the need for privacy by the customer while going on a lingering shopping spree. Similar strategy is being followed by other global brands such as Marks & Spencers which conducted a pilot run of 6 standalone beauty and lingerie stores.

Figure 1: Five Year Trend of Global Intimate Wear Trade (2012 to 2016) in US$ Bn.

Source: UN Comtrade and Wazir Analysis

Figure 2: Top exporting countries for innerwear in 2016

Intimate wear is an integral segment of apparel manufacturing. It is estimated that around 10% of a consumer’s expenditure on garments constitute of shopping for intimate wear. Although globally intimate wear manufacturing has reached new heights, Indian intimate wear manufacturing sector is still at its nascent stage. India has yet to realize its full potential in the same.

Indian Intimate wear market has been growing rapidly since last few years. The current market size is estimated to be US$ 4.8 Bn. which is an 11% increase since 2014. Share of intimate wear market is approx. 8 % of India’s domestic apparel market. The market for intimate wear is expected to grow at a healthy pace in the coming years. By year 2025, the market is estimated to reach US$ 13 Bn..

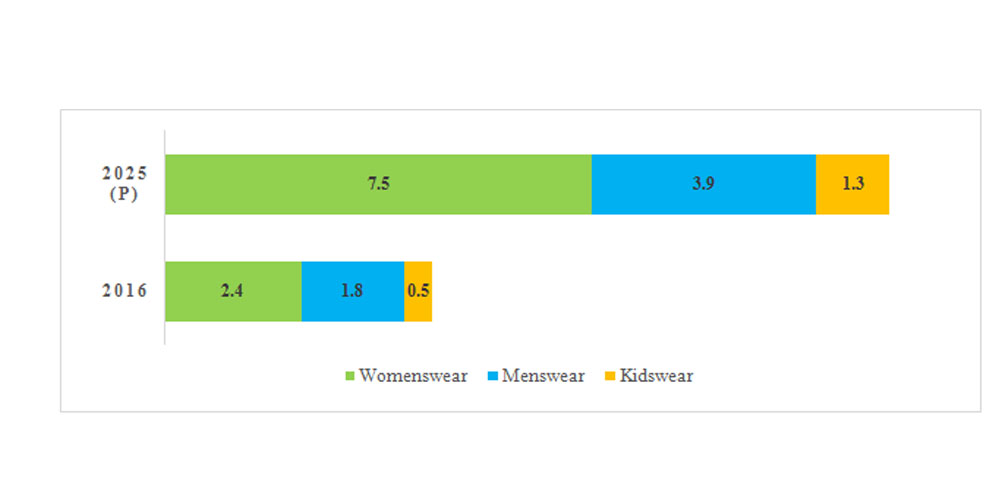

In terms of product segmentation, intimate wear in India can be categorized into three major segments, viz., Womens’ innerwear. Mens’ inner wear and Kids’ innerwear. Indian intimate wear market is dominated by womens’ inner wear which occupies a little over 50% share of the market. The value of womens’ inner wear market is estimated to be around US$ 2.4 Bn. This is followed by mens’ inner wear segment accounting for 38% share of the market with an estimated market size of US$ 1.8 Bn.. Kids’ inner wear segment is surprisingly low in terms of value of US$ 0.5 Bn. with market share of only 10%. Womens’ wear is predicted to be the highest growing category out of the three and is expected to reach 60% market share by 2025.

Figure 3: Growth of Innerwear Segments in India upto 2025 (US$ Bn.)

Source: Wazir Analysis

The innerwear manufactures present in India can be categorized as follows:

Indigenous small scale manufacturers: Majority of the Indian intimate wear manufacturing takes place in Small Scale Industrial (SSI) units operating in various parts of India and catering to local market requirements. These units are typically proprietary firms, with an average size per unit not exceeding 15 to 20 machines, making simple, inexpensive products.

Indigenous large-scale manufacturers without any foreign tie-ups: A significant number of manufacturers without any foreign tie-ups / collaboration have been quite successful in the Indian market. This category of manufacturers is capable of making products using different types of raw materials. Notable players in this segment include Groversons, Rupa, Amul, Lux, Bodycare, TT, Maxwell Industries, Pratibha Syntex, Juliet Apparel, Sonari Lingerie, etc.

Indian large scale manufacturers with foreign tie-up / collaborations: Some Indian companies have entered into manufacturing, marketing or brand licensing tie-ups with international players with focus on domestic as well as export markets. Examples in this category include Page Industries, which has a brand licensing arrangement with Jockey (USA).

The innerwear market is being driven by few key factors or trends. All these factors spell good news for the current manufacturers of inner wear in the country and also for the companies wishful of entering the segment. These factors contribute to the rising demand in this segment in India and the world and tremendous scope available for businesses

a) Rapid Urbanization, Rurbanization & Changing Demographics: India is going through the process of rapid growth in urban population as well as increase in the number of towns and cities on its path of transforming from a developing nation to a developed one. While on one hand masses are shifting base to cities and metros for better opportunities, on the other hand rural population is also becoming infused with urban patterns and culture which is referred to as Rurbanization. In addition, demographics of the country is changing with increase in working age population, male-female ratio, increasing female literacy rates, changing birth and death rates etc.

b) Growing Consumer Profiles: The sudden mushrooming growth rate of the innerwear segment stems from the ever-changing consumer profiles. New age consumers are well-educated, fashion and quality conscious, well-dressed with better spending capacity owing to higher disposable incomes combined with a sense of clarity of their needs, wants and desires. Consumers segment is mainly from the aspirational working class and upper class with currency they are willing to expend. Being associated with distinguished brand names and need for sense of belonging to the upper segments of the society is what shapes the consumers’ needs for such items. Further, the customer also has been aware of the functional properties of usage of good quality innerwear for support and protection of the body.

c) Rising Working Women Population: The number of working women has escalated tremendously in the last few years due to growing awareness as a society which is taking steps in higher education and working opportunities for women. The taste and style of working women are ever evolving coupled with freedom to spend higher. The lingerie basket of women has graduated from mismatched bras and panties to matching sets, bikinis, swim wear, shape wear, sportswear, lounge wear and night wear. The lines between athleisure and casual sportswear are being blurred as inner wear such as trendy sports bras and crop tops are also emerging in the form of outerwear. In a similar fashion, mens’ inner wear hamper is also expanding. Men are as well groomed as women and take special care to choose the right products suited to their needs.

d) Growth of Organized and Online Retail: Retailing is one of the important sectors of the Indian economy contributing to 20% of the GDP of the country. Indian retail market is among the top five retail markets in the world and is expected to touch US$ 2 trillion by 2025. Emerging organized retail is beneficial for manufacturers looking to invest in this sector. The Government’s decision to allow 100% FDI in retail has been a great boost to the sector with several international players entering the domestic market. Apart from brick-and-mortar retail, the click-and-mortar retail more commonly known as online retail is also on a high growth trajectory on account of the digital revolution going on in the country. India is expected to become the fastest growing e-commerce market with robust investment as its backbone.

e) Emerging Categories: Indian consumers are becoming increasingly aware of the kind of ensemble they want for any occasion or purpose. This has led to increase in demand in special categories within intimate wear such as shapewear, sleepwear, swimwear, athleisure etc. Among these, the sleepwear category has already seen growth in both branded and unbranded segments. However, other categories such as shapewear and swimwear still present a lot of possibilities. Some of the promising categories are:

1) Sleepwear: The market for sleepwear is continuously expanding as sleepwear has emerged as an essential clothing item and a fashion statement. Organized players have entered into the segment over the last few years with heavy investments in R&D to increase the range of products and come up with new / better functionalities. Trendy sleepwear is now a mix of t-shirts, shorts, capris, pyjamas, nightgowns along with the conventional kurta and pyjama. Fabrics used for sleepwear are mainly of cotton-blended type with different prints. Still, a large part of the segment remains unorganized, which can be tapped into by the manufacturers.

2) Loungewear: Loungewear is basically nightwear which can be converted into multi-purpose daywear as well. For example, taking a morning walk in your glam pyjamas or wearing your chic yet comfortable capris / shorts and tee for a run. There is unexploited potential in this segment due to the multi-functionality of the product which gives opportunity to the manufacturer to experiment with fabrics, prints and designs. Growth in man-made fibres such as modal fibres is also a contributing factor to growth of loungewear. Global brands such as GAP, Marks & Spencers and Calvin Klein have already made headway into this segment.

3) Thermals: Another booming category is thermals and many domestic and international brands have diversified into this category. Some of the key players in thermals are Monte Carlo, Jockey, Rupa, Hanes, Dixcy etc. Van Heusen and other premium brands have also launched thermals and mens’ innerwear and are promoting it on digital and print media. Other small players also exist which cater to local area requirements.

There are still some key issues faced by India, which have to be tackled so Indian industry can reach its full potential. Some of these challenges are:

To tap the market opportunity and address the key challenges faced by the industry, some of the initiatives that may be taken are discussed below:

a) Government:

Government should provide conducive & predictable business environment. Since this is the most labour intensive industry, there is a need to reform the dated labour laws as a prime policy initiative. This policy change will support industry to make investments in larger units, enhance their business performance, generate more employment especially for women and bring foreign currency.

Recently, the Intimate Apparel industry has seen tremendous demand for moulded cup bras, which is ideally made of polyurethane. Due to non-availability of moulded cups in India, most brands / manufacturers have been importing moulded cups from other countries. While importing, they have found anomalies in Customs Classification & Tariff which makes the bra Cups (component) much more expensive than importing a readymade moulded cup bra. Hence, there is a need to resolve such the difficulties being faced by the domestic manufacturers of Intimate Apparel.

b) Manufacturers & Brands:

c) Retailers

It is noteworthy that Indian intimate wear industry has reached a tipping point and is geared to take the next leap of growth. The time is right to take the benefit of the massive growth potential in the sector. Manufacturers can adopt a mix of strategies to enter into this segment such as product diversification, strategic tie-ups among domestic brands or with international brands, etc. Also, focus should be put towards better product designs and increased functionalities to make Indian products globally competitive and catapult Indian exports of intimate wear to the top. Central and State Governments should also recognize the promising growth of intimate wear segment and arrange for support in terms of policy reforms and subsidies etc. to aid in further growth. Last but not the least, organized and online retailers who have not yet included intimate wear in their merchandize assortment should consider doing so to provide all-inclusive shopping experience to customers as well as maximize profits.

The article has been authored by Sanjay Arora, Business Director, Anubha Sehgal, Senior Consultant and Barna Deka, Consultant.

It was published in June 2018 in Fibre2Fashion.